The COVID-19 pandemic has significantly altered how medical services are delivered and received. This shift has been particularly evident in the case of home health services, where there has been a noticeable increase in preference among Medicare beneficiaries.

This trend away from traditional in-person medical services towards home-based care presents both challenges and opportunities for Home Health Agencies (HHAs). Understanding the home healthcare reimbursement process is no longer just beneficial; it’s essential for maintaining the financial health of your practice and enhancing revenue streams.

To assist healthcare providers in adapting to these changes, we’ve crafted a comprehensive guide focused on demystifying the home health Medicare reimbursement process. This guide is a must-read for anyone looking to stay abreast of these developments and ensure the financial stability of their home health services.

To be eligible for home healthcare reimbursements, it’s crucial to determine if your Home Health Agency (HHA) meets the necessary qualifications. Your practice’s ability to benefit from healthcare reimbursements hinges on understanding the scope of services offered under Medicare Parts A and B. This knowledge is vital for ensuring that your HHA is in a position to receive these reimbursements, thereby securing the financial benefits they offer.

For Home Health Agencies (HHAs) seeking reimbursement under Medicare Part A, several specific criteria must be met. Firstly, the services provided must be deemed medically necessary and prescribed by a certified healthcare professional. This typically involves care that requires the skills of professional healthcare providers, such as nursing or therapy services.

Additionally, the patient receiving these services must be under the care of a physician who regularly reviews their home health plan. It’s essential that the patient is homebound, meaning they are unable to leave their home without considerable effort or assistance due to their medical condition.

Furthermore, the HHA providing these services must be officially certified by Medicare. This certification process ensures that the agency adheres to the federal standards set for patient care and management.

Lastly, the services provided under Part A must be part of a patient’s treatment plan and are usually short-term, focusing on recovery from an illness, injury, or surgery. This plan should be regularly reviewed and updated to reflect the patient’s current health needs.

Meeting these criteria is fundamental for HHAs to qualify for Medicare Part A reimbursement, ensuring that patients receive necessary home-based care while the agency secures its financial viability.

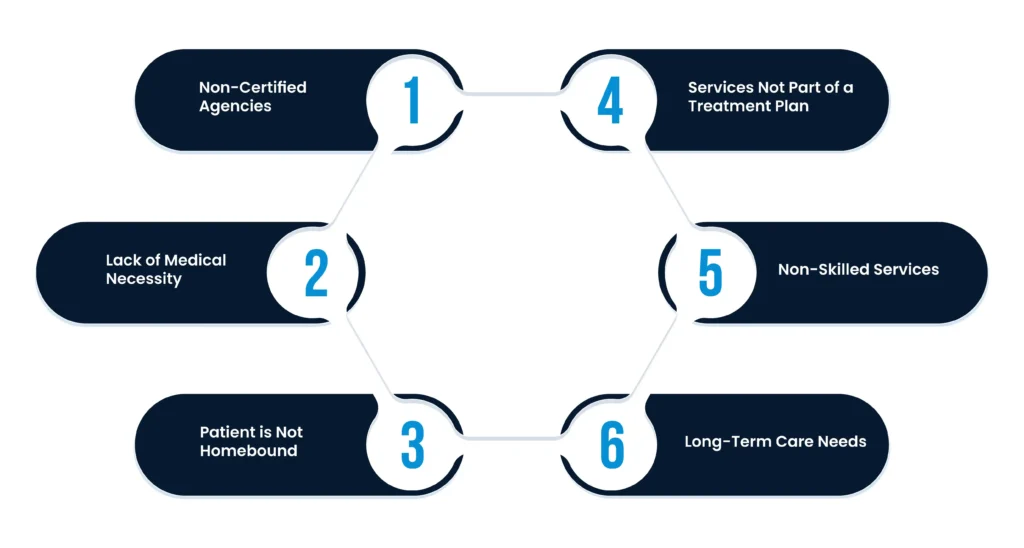

There are several scenarios in which a Home Health Agency (HHA) may not qualify for Medicare Part A benefits. These include:

Non-Certified Agencies: If the HHA is not officially certified by Medicare, it cannot receive reimbursements under Part A. Medicare certification is a crucial requirement, ensuring that the agency meets specific standards for patient care and management.

Lack of Medical Necessity: Services that are not deemed medically necessary by a healthcare professional will not be covered. Medicare Part A specifically covers services that are essential for the patient’s health and prescribed as part of a treatment plan.

Patient is Not Homebound: If the patient is not considered homebound, meaning they can leave their home without considerable difficulty or assistance, Medicare Part A will not cover the services. Being homebound is a key criterion for home health care coverage.

Services Not Part of a Treatment Plan: Services must be part of a physician-approved treatment plan that is regularly reviewed and updated. If the provided care is not part of such a plan, it won’t qualify for Part A reimbursement.

Non-Skilled Services: Medicare Part A primarily covers skilled nursing care, physical therapy, speech-language pathology services, and continued occupational therapy. If the HHA provides predominantly non-skilled care, such as basic personal care or homemaking services, these are generally not covered under Part A.

Long-Term Care Needs: Medicare Part A is designed for short-term care, focusing on recovery and rehabilitation. If a patient requires long-term or custodial care, which is not aimed at rehabilitation or recovery, this would not be covered under Part A.

If a Home Health Agency (HHA) cannot avail of Medicare Part A benefits, Medicare Part B may come into play as an alternative. Part B covers a different range of services and has its own set of criteria, which can provide a viable option for HHAs to receive reimbursement for services not covered under Part A.

Outpatient Services: Unlike Part A, which focuses on homebound patients needing skilled care, Part B covers outpatient medical services. This includes physician visits, outpatient hospital services, and some home health services.

Preventive Services and Supplies: Part B also covers preventive services like flu shots and certain medical supplies like wheelchairs and walkers, which are not typically covered under Part A.

Therapy Services: Physical, occupational, and speech-language therapy services are covered under Part B, even if the patient is not homebound. This provides an avenue for HHAs to offer and receive reimbursement for these therapies.

Less Restrictive Eligibility: The eligibility criteria for Part B are generally less restrictive compared to Part A. For example, the requirement for the patient to be homebound is not applicable under Part B.

Direct Billing: HHAs can bill Medicare directly for Part B services, which include specific medical treatments and therapies that do not require the patient to be homebound or part of a short-term recovery plan.

Secondary Option for Long-Term Care: While long-term care is still generally not covered, some aspects of long-term therapy or care that are medical in nature may be covered under Part B.

Applying for Medicare reimbursement for home health care involves a detailed process that Home Health Agencies (HHAs) need to follow carefully. Here’s a summarized guide based on information from various sources:

Before applying, it’s important to understand what services are covered under Medicare Part A and Part B. Medicare covers a range of services, including skilled nursing care, therapy services, and medical social services, provided they are necessary and the patient is homebound.

Consistent and accurate documentation and billing are essential. This includes having detailed records of services provided, along with necessary information like invoice numbers, HCPCS codes, patient names, service descriptions, dates of services, and charges.

Claims for Medicare reimbursement should be submitted to the relevant MAC. This can be done electronically, and it’s crucial to ensure that all required documentation is included to facilitate efficient processing.

Adhering to the best practices and consolidated billing instructions set by the Centers for Medicare & Medicaid Services (CMS) is crucial for the smooth processing of claims.

HHAs should keep abreast of the latest changes in CMS policies. For example, recent updates include the introduction of the Notice of Admission (NOA) and the Home Health Value-Based Purchasing (HHVBP) model. These changes emphasize the importance of timely submission of documentation and a focus on the quality of patient care.

Incorporating telehealth and remote patient monitoring solutions can be beneficial. These technologies have shown to help cut costs and improve the quality of care, which is increasingly important under capitation-based payment models.

The PDGM, which focuses on 30-day periods of care, emphasizes the need for HHAs to increase care coordination and patient oversight. This model aims to enhance cost-efficiency and quality of care within shorter time spans.

In conclusion, understanding Medicare reimbursement is key for Home Health Agencies (HHAs) to thrive, especially after COVID-19. It’s important to understand Medicare, keep up with rules, ensure correct paperwork, and use new methods like telehealth and PDGM. This helps HHAs deliver better care, stay financially sound, and support the goal of providing top-notch home care.

Talk to an Expert Now