Since the enactment of the Affordable Care Act (ACA), there has been a rapid transformation in healthcare payment models. The ACA incentivized healthcare providers to prioritize affordability for patients without compromising the quality of care delivered.

This paradigm shift led to the transition from the traditional fee-for-service payment model to the value-based care payment model, which places a paramount emphasis on the fusion of cost-efficiency and the delivery of high-quality healthcare services.

Traditionally, providers would get paid a set fee for each medical service they performed, like a doctor’s visit or a surgery. But now, they are moving towards a different system called “capitated care.” In this blog guide we are going to delve into what are capitation payments? what does this mean for the future of healthcare? Let’s explore how this innovative approach is creating a ripple effect across the healthcare system.

Capitation payment model operates on the principle of providing healthcare providers with a predetermined, fixed amount of money for each patient they are responsible for, typically over a set period of time.

These payments are made by entities like health insurance companies or health maintenance organizations (HMOs) to the healthcare professionals or facilities, such as doctors, clinics, or hospitals.

Importantly, these payments are established in advance and do not change during the contract period, regardless of the number of healthcare services that are actually provided to the patients.

In simpler terms, it means that healthcare providers receive a set amount of money per patient, and they must manage their patient’s healthcare needs within that budget, regardless of whether the patient needs a lot of medical services or just a few.

Primary Capitation Agreement: In a primary capitation agreement, a managed care organization like a Health Maintenance Organization (HMO) directly pays a physician or a group of physicians for providing healthcare services to the HMO’s members. This means the primary care provider receives a fixed amount for taking care of a patient’s basic healthcare needs.

Secondary Capitation Agreement: This type of agreement comes into play when an HMO arranges a contract involving primary care physicians and another healthcare service provider, often referred to as a “secondary” provider. These secondary providers can include diagnostic services, imaging centers, specialists, and other healthcare professionals. The primary care physician is responsible for coordinating the patient’s care, including referrals to these secondary providers as needed.

Global Capitation Agreement: The term “global capitation” can refer to a couple of different arrangements:

Let’s take and example scenario to get a better understand of how capitation payments work. Suppose a therapist Dr smith in a rehab practice has an agreement with a local health insurance company. Under this agreement, they receives a fixed monthly payment for each patient enrolled in the plan, let’s say $500 per patient per month. This payment is made regardless of whether the patient visits Dr. Smith that month or not.

For example, if Dr. Smith has 100 patients enrolled under this plan, she receives $50,000 monthly. This amount is to cover all necessary healthcare services for these patients. If a patient needs no care that month, the payment remains the same. Conversely, if a patient requires multiple visits or treatments, Dr. Smith still receives the same fixed amount.

With capitation models in place, the overall focus of providers shifts to maintain the overall health of patients. Since their income is no longer tied to the number of services rendered, it’s in their best interest to keep patients as healthy as possible to avoid costly treatments or hospitalizations.

This model encourages providers to invest more in preventive care measures, regular check-ups, and patient education. It fosters a closer patient-doctor relationship, where the goal is overall wellness rather than reactionary treatment.

In capitation payment models, a range of healthcare services is funded through predetermined payments, ensuring comprehensive care for patients while promoting cost-efficiency. Some of the covered services are :-

Aspect | Capitation Payment Model | Fee-for-Service Model |

Payment Structure | Fixed payment per patient | Payment based on each service or procedure |

Incentives | Incentivizes efficient use of healthcare resources and focus on preventive care to minimize the need for treatments | Incentivizes providing more services, as payment increases with more procedures or treatments. |

Cost Predictability | More predictable for both the insurer and the patient, as payments are fixed. | Less predictable, costs can vary significantly based on the number and type of services rendered. |

Quality of Care | Can lead to a focus on overall patient health and long-term outcomes. | Can lead to focus on quantity of care rather than quality, as payment is tied to the number of services. |

Utilization of Services | Potential for underutilization of services as providers may aim to minimize costs. | Potential for overutilization of services, leading to unnecessary treatments or procedures. |

Patient Perspective | Can lead to a perception of limited access to care or services, as providers might limit resources. | Perceived as having more access to a variety of services, but can result in higher out-of-pocket expenses. |

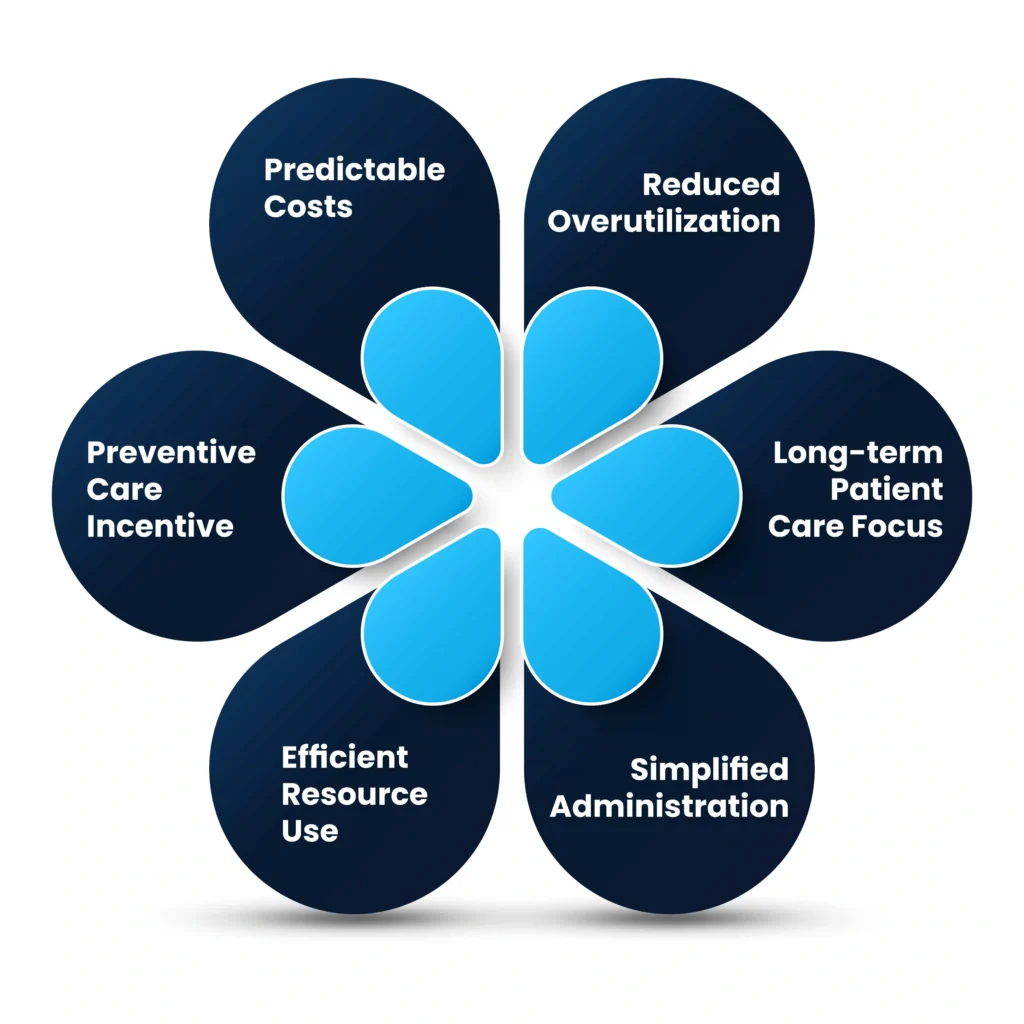

Predictable Costs: Capitation provides a fixed cost for healthcare insurers and patients, making budgeting easier and more predictable.

Preventive Care Incentive: Providers are incentivized to focus on preventive care, as this can reduce the need for expensive treatments later.

Efficient Resource Use: Encourages healthcare providers to use resources more efficiently, potentially reducing unnecessary tests and procedures.

Simplified Administration: Simplifies billing and administration, as payments are fixed and not tied to the number of services provided.

Long-term Patient Care Focus: Promotes a focus on the patient’s overall long-term health and well-being.

Reduced Overutilization: Helps in reducing the overutilization of healthcare services, which is common in fee-for-service models.

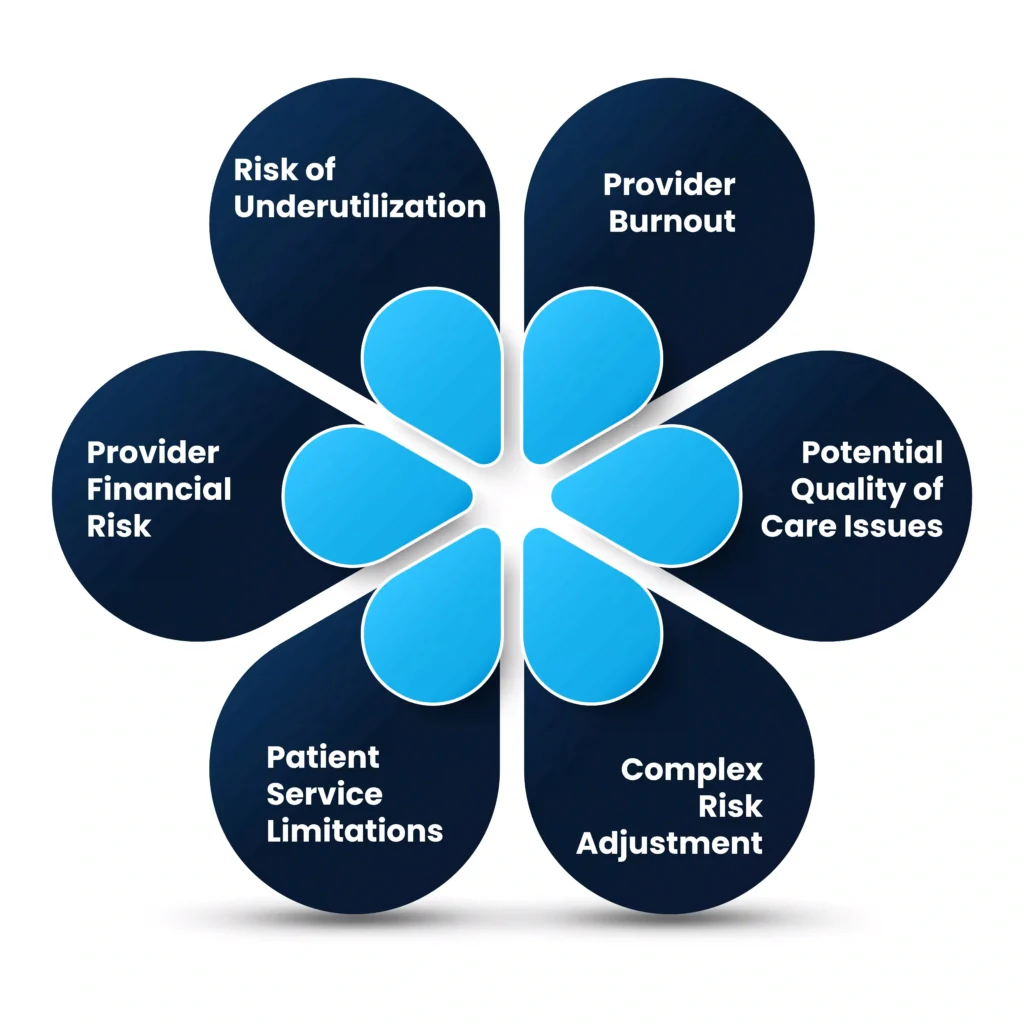

Risk of Underutilization: There’s a risk that providers might underprovide care to save costs, potentially impacting patient care quality.

Provider Financial Risk: Providers bear more financial risk, especially if they have patients requiring expensive or extensive care.

Patient Service Limitations: Patients might perceive limitations in accessing certain services or specialists, as providers might restrict services to control costs.

Complex Risk Adjustment: Determining appropriate capitation rates can be complex and might not always reflect the actual care needs of the population.

Potential Quality of Care Issues: While preventive care is incentivized, there might be a temptation for providers to offer less care than needed to maintain profitability.

Provider Burnout: The model might lead to provider burnout due to the constant pressure of managing care within a fixed budget.

In conclusion, the shift from fee-for-service to capitation payment models in healthcare marks a significant transformation in how healthcare services are funded and delivered. This model promotes efficiency and cost-effectiveness while potentially enhancing the quality of care through a focus on long-term health outcomes.

However, it also brings challenges such as the risk of underutilization of services, financial risks for providers, and potential limitations in patient access to certain services. Overall, capitation payments represent a balance between cost containment and quality care, aiming to create a more sustainable and patient-centric healthcare system.

Talk to an Expert Now